With Joe Biden the winner of the US presidential election, we take a closer look at how control of the US Senate could affect his proposals, compare and contrast them with current tax law for businesses and individuals, and recap economic reactions post-election.

House of Representatives and Senate

Democrat retained the majority in the US House of Representatives. In the US Senate, there’s an even 50–50 split between Democrats and Republicans with Vice President-elect Kamala Harris casting the tie-breaking vote.

Other Mechanisms for Changes

A president can also implement limited tax policy through executive orders or Treasury Regulations.

Here are some examples:

- President Trump on August 8, 2020, implemented the elective deferral of withholding, deposit, and payment of certain payroll taxes through year-end. See our Alert on this topic.

- The Obama Administration on August 2, 2016, promulgated the Section 2704 regulations in an effort to limit discounts of family-owned entities for estate and gift tax purposes and issued regulations under Sections 7874 and 367 addressing inversion transactions and limiting utilization post-inversion earnings stripping strategies.

Executive action can also include removing or changing proposed regulations. For instance, the Trump administration withdrew the above proposed Section 2704 regulations in 2017.

Biden Tax Proposals

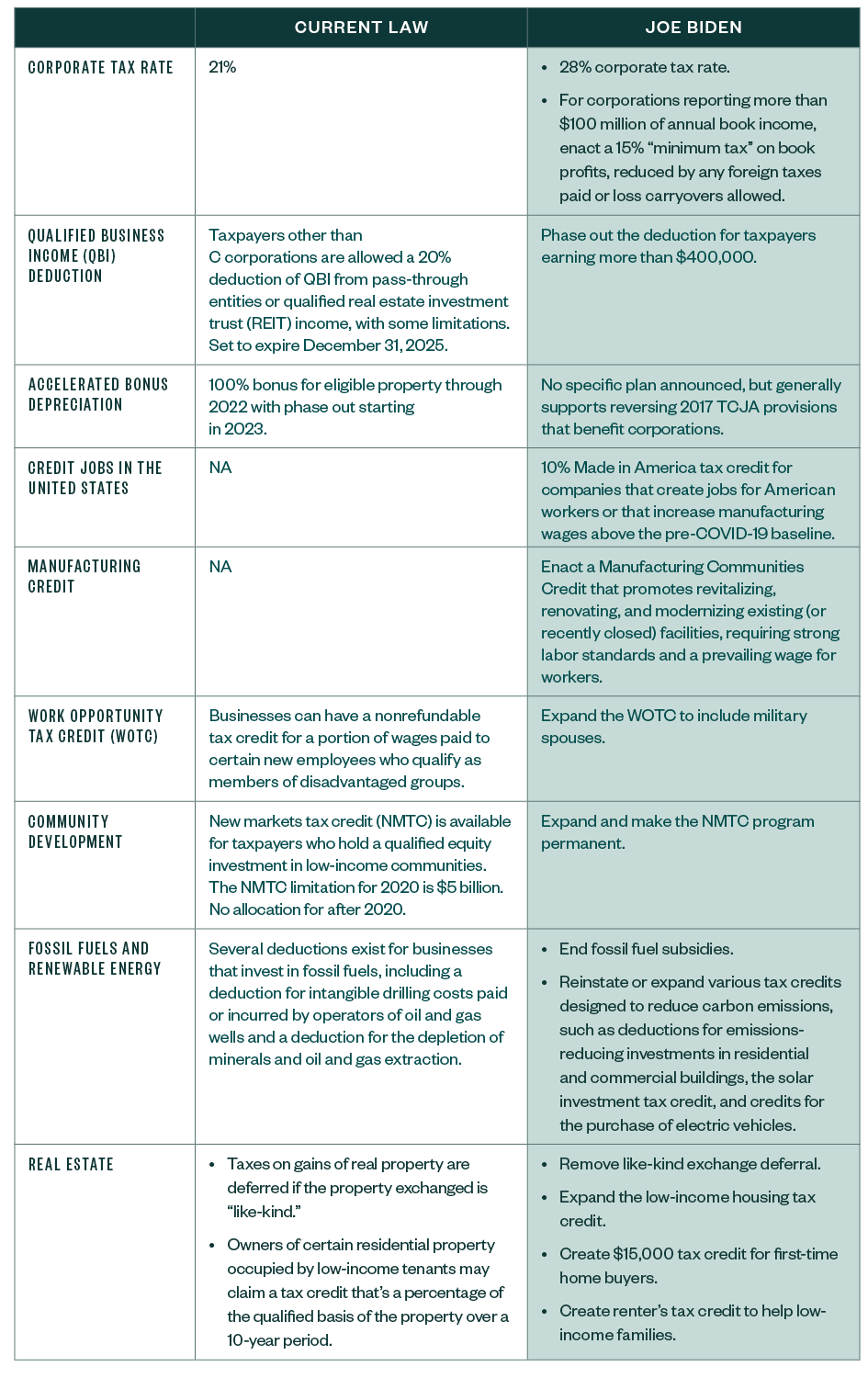

Below is a side-by-side comparison that shows current tax law as well as proposed changes from President-elect Biden, including those for businesses (both domestic and those operating internationally) and individuals.

Businesses

There’s anticipation that a Biden presidency’s tax policy could reverse many of the business-friendly provisions enacted via the 2017 tax reform act (TCJA) in an effort to raise revenue. Many of the proposed tax increases and eliminations of preferences are directed toward high-income taxpayers and larger multinational businesses.

The Biden proposal impact would be felt across business entity types and by the individuals who own those businesses. Here are some highlights:

- Corporate taxpayers. The proposed tax rate increase is still lower than the pre-TCJA 35% corporate tax rate. For some corporate taxpayers, the book value of net operating loss carryforwards would increase as the corporate rate increases, however the 15% minimum tax may blunt this benefit for corporations with annual book income over $100 million.

- Flow-through entities. The qualified business income (QBI) deduction, also enacted by TCJA, allows individuals who own businesses taxed as sole proprietorships, partnerships, and S corporations to reduce their effective highest individual tax rate from 37% to 29.6%, by way of a deduction based on 20% of the qualified business income earned. Under the Biden proposal, the QBI deduction could be phased out for business owners whose annual income exceeds $400,000.

- Top bracket of capital gains tax. This proposal could increase to equal the top ordinary income tax bracket, eliminating favorable tax treatment for the highest income earners. Impact of the top capital gain rate increase will be felt most in the context of how transactions impact corporate shareholders and flow-through entity owners.

- Choice of entity. Decisions around entity choice could become more challenging with Biden’s tax proposals. Higher corporate rates and less substantial increases in individual rates could drive more businesses to seek the tax efficiencies of flow-through entities; however, a corporation won’t be impacted by an increased top capital gain rate and the phase out of the QBI deduction. Ultimately, changes to individual tax rates impact businesses as well by affecting the decision-making of business owners.

- Credits and incentives. A number of new or expanded tax credits and incentives are included to help reduce tax burdens for small businesses and working-class Americans.

Comparison Table for Business Proposals

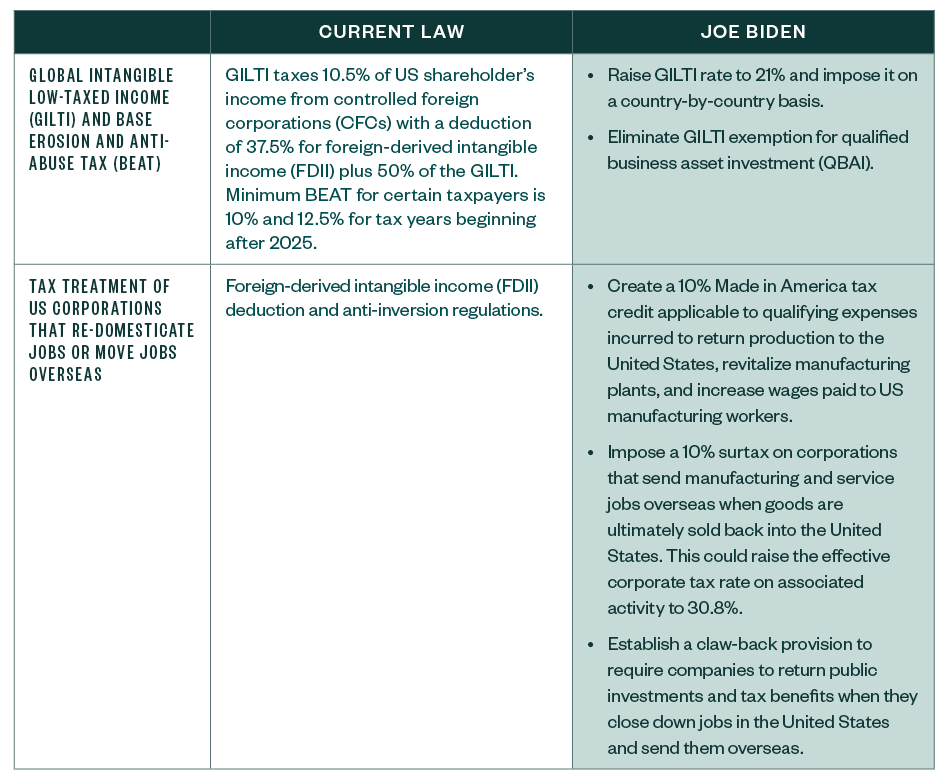

International

Biden’s international tax proposals aim to help incentivize US companies to bring production jobs back to the United States, as well as eliminate some corporate tax breaks passed by the Trump administration.

Proposed plans could provide a 10% “Made in America” tax credit to companies to encourage onshoring of manufacturing activity and the expansion of US production jobs. He also proposed plans that could eliminate the 50% deduction from global intangible low-taxed income (GILTI) currently available to C corporations as well as impose a 10% surtax on imports from offshored business activity.

While few details have been released regarding the international tax provisions contemplated by Biden’s plan, the changes to the GILTI provision alone could raise $289.7 billion in revenue over the next 10 years.

Comparison Table for International Proposals

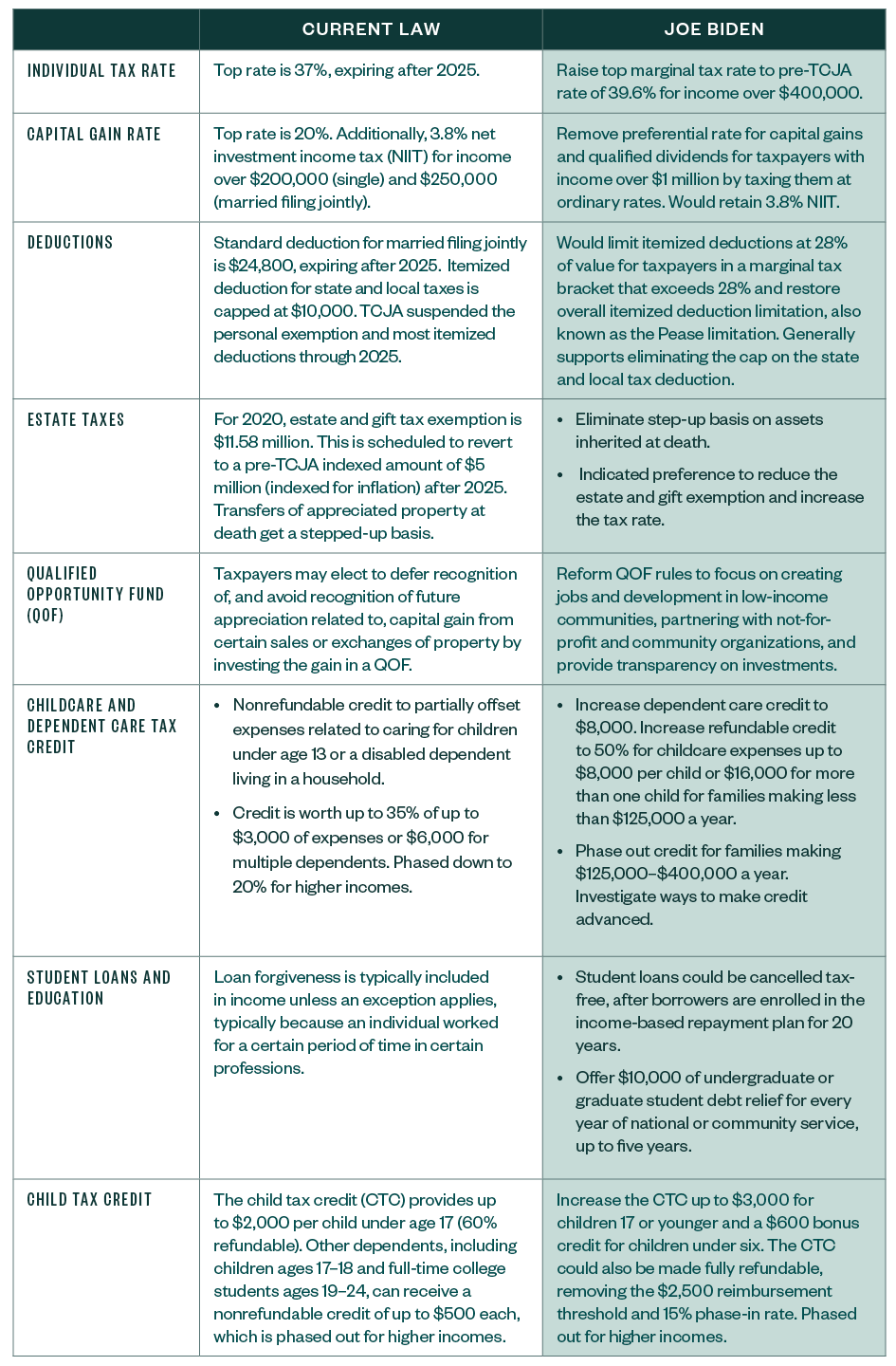

Individuals

Biden’s tax proposals would provide a tax increase for higher income taxpayers with the following items:

- Top ordinary income tax rate could return to its pre-2018 rate of 39.6%

- Itemized deductions limited to 28% of adjusted gross income

- Return of the 3% phaseout of itemized deductions for higher incomes

Capital gains and qualified dividends for taxpayers with income over $1 million would be taxed as ordinary income ending a preference for capital gains that’s existed since 1922 (with the exception of 1988 to 1990 when the highest marginal tax rate on all income was 28%).

The estate and gift tax exemption could be significantly reduced from its current level of $11.58 million. Biden has provided limited information about his plans but indicated his desire to reduce the exemption and increase the rate. The elimination of the basis step-up of inherited assets also was proposed.

An open question is if a Biden administration could change the final Treasury Regulations issued on November 26, 2019. According to the regulations, gifts that utilized the higher exemption amount before it’s currently set to be reduced on January 1, 2026, won’t be clawed back into a taxpayer’s estate if the exemption is later decreased.

Expansion of Individual Tax Credits

On the other end of the spectrum, Biden’s proposals include increasing the child care tax credit, child tax credit, and student loan relief; reinstating the first-time home buyer’s credit; and increasing the eligibility for the premium credit under the Affordable Care Act. These proposals could also increase the refundability of many of the previously mentioned credits.

Comparison Table for Proposals for Individuals

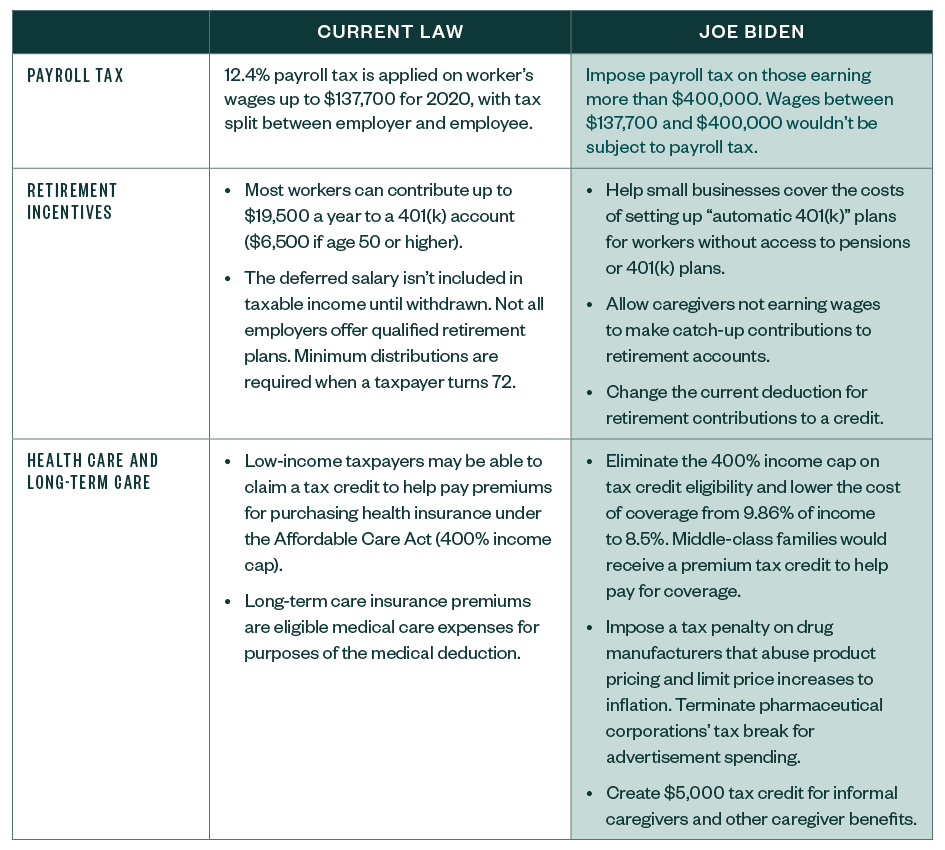

Other Tax Provisions

Biden proposed additional changes to retirement accounts, payroll tax, and health care.

For retirement accounts, Biden’s proposal would aim to increase access and participation by subsidizing the establishment of additional employer plans and changing the current individual deduction to a credit, limiting the tax benefit for higher income taxpayers while incentivizing lower income earners.

For example, using a 26% rate, a taxpayer earning $600,000 and contributing the maximum of $19,500 to a 401(k) plan receives a tax credit of 26 cents on each dollar, or $5,070 (versus the current law, which is a $19,500 deduction at 37% or $7,215). However, a person earning $50,000 and contributing $5,000 to the same 401(k) plan would receive a credit of $1,300, which is likely more than double what they are currently receiving as a benefit, assuming a 12% marginal tax rate.

Comparison Table for Other Provisions

Economic Reactions

In the weeks preceding the US presidential election, the stock market was pricing in the potential for large fiscal spending. The anticipation of a blue wave election, wherein Democrats win control of Congress and the presidency, caused longer-term Treasury bond yields to move higher—the curve steepened—and there was rotation from growth and technology stocks to more cyclical reflation plays.

However, post-election, that trade reversed course somewhat with bond yields slipping 10 basis points on November 4, 2020, reaching a two-week low—prices increased—and cyclical stocks sold off while technology and health care rallied.

In following days, stocks were mostly higher across the board because Wall Street priced in the prospects of a divided government with a Republican-controlled Senate.

We’re Here to Help

For questions or insight on how some of these proposals might affect your business or individual finances, contact your Moss Adams professional.